Banking and telecom are having a moment. We’re seeing an explosion of new bank MVNO offerings from financial services providers, shaking up the banking industry and providing customers with more choice, flexibility and value.

Forward-thinking banks have recognized the powerful synergy between financial services and mobile connectivity. With 98% of American adults owning a smartphone and over half of U.S. banking customers relying on apps or digital channels to manage their finances, often checking in daily, the link between how people manage their money and stay connected is undeniable. Banking and connectivity aren’t just related, they’re becoming interconnected in ways we haven’t seen before.

At the same time, both sectors are undergoing major transformation. Digital-native neobanks are redefining what banking looks like, while telecom is being reinvented through cloud-native models like Telecom-as-a-Service (TaaS), eSIM technology, and programmable network solutions. These innovations are dismantling legacy barriers and opening the door to a more seamless, interoperable future.

As this convergence accelerates, we explore how TaaS is unlocking new possibilities for consumer banks, fintechs, neobanks, and payment providers—empowering them to embed connectivity into their offerings and redefine what it means to serve the modern customer.

What is a bank MVNO?

A bank MVNO is a financial services provider–whether a neobank, traditional bank, payment provider, or financial institution—that starts offering mobile connectivity products directly to its customers as part of a holistic telecom and banking solution. This could mean a consumer bank embedding mobile services directly into its banking app or an enterprise bank launching a compliance-first mobile product that keeps global employees securely connected.

Examples of bank MVNOs already on the market

A great starting point is to examine the current market landscape. In recent years, we’ve seen notable examples of banking and telecom offerings merging, demonstrating the valuable potential of a cross-industry collaboration between two essential services. Here are four examples of banks going beyond ‘just banking’ with new and compelling connectivity offerings.

Revolut

In February 2024, Revolut – a $45 billion UK fintech – launched their eSIM service for premium subscribers. They are the first financial institution in the UK to launch eSIM, which offers users a cost-effective way to access data plans when travelling to over 100 different countries without incurring unexpected roaming charges. In just a few clicks, Revolut users can download and install a single eSIM which they can then manage via their Revolut App whenever they need to top-up.

Revolut has also recently announced plans to launch full mobile services for customers in the UK and Germany later this year. These offerings will include unlimited domestic calls and data, along with 20GB of roaming data across the EU and U.S.

Nubank

In May 2024, we saw Nubank – a Brazilian neobank – follow with their own eSIM offering. NuCel is being gradually rolled out to Nubank’s 114 million customers, offering three plans with monthly data caps at 15GB, 20GB and 35GB, and is designed to transform the customer experience and expand the company’s offering beyond financial services.

Capitex Bank

Capitec Connect, the MVNO of South Africa’s Capitec Bank, is another example of a new bank MVNO. Since its launch in 2022, Capitec Connect has experienced impressive growth, with a 74% increase in active subscribers over the past six months, reaching a strong 1.6 million customers. With compelling offerings that are both affordable and reward positive banking behavior — including 1GB of free monthly data for credit card holders with verified Capitec Connect numbers — the company has quickly become one of the top MVNOs in South Africa.

N26

The latest to launch their mobile offering is German neobank, N26, who announced this month that it would start offering flexible and affordable mobile plans to its German customer base. The mobile plans will operate via eSIM and customers will be able to activate them directly within their N26 banking app. All of their plans will come with unlimited national calls and text messages, as well as free EU and EEA roaming.

How to become a bank MVNO with Telecom-as-a-Service (TaaS)

Traditional telecom models have long deterred banks and other brands from entering the connectivity space – discouraged by high complexity, cost and a lack of flexibility. This is no longer the case with the advent of cloud telecom innovations, in particular Telecom-as-a-Service (TaaS).

Telecom-as-a-Service (TaaS) is transforming the telecom landscape, empowering businesses and brands to access, deploy and monetize connectivity in innovative ways, underpinned by a cloud-native, open and flexible ethos.

Offering a branded telecom service to existing banking customers (whether consumers or enterprise banks themselves) doesn’t need to be viewed as a separate business but as a means to augment and improve the overall fintech experience already being offered to customers. The two essential services can be entwined together to create a stickiness that enhances long-term customer satisfaction, loyalty and retention.

Consumers are increasingly open to compelling new mobile offerings. According to OXIO’s 2025 Mobile Consumer Survey, while most consumers are generally satisfied with their current provider, 75% would switch if offered a better deal with more personalized features. Notably, over 20% of American consumers would consider purchasing their mobile plan directly from their bank—highlighting a growing appetite for alternative, value-driven connectivity experiences.

Now is the moment for banks and financial institutions to seize this opportunity—and Telecom-as-a-Service is the key to making it happen.

Bank MVNO use cases with TaaS

Commercial banking MVNO

Commercial banks, like Wells Fargo, Capital One and Bank of America, could fundamentally shift their revenue and customer experience strategies with the addition of a mobile product within their offerings – embedded directly within their existing and well honed banking app.

Consumer banks now have cloud-native solutions like TaaS that enable them to harness the natural synergy between banking and telecom, where they can bring the strengths of both offerings together under one holistic app offering. A banking app that can be a hub for mobile services can give banks a new competitive edge, enabling them to open up a new line of revenue, increase new customer acquisition and drive wallet-share growth.

B2B enterprise bank connectivity

B2B enterprise banking has long suffered with communication compliance issues, often resulting in large fines and reputational damage. US and UK banks have been fined over $2.5 billion in recent years for non-compliant business communication practices and recordkeeping failures.

With the advent of global and cloud-native telecom offerings, B2B banks now have the tools and data to overcome these regulatory hurdles where they have their own global network that meets worldwide communication compliance and gives them the flexibility to build their own personalised employee plans based on job roles, location, travel and more.

Secure eSIM authentication

Two-factor authentication (2FA) has long protected digital identities, but its weaknesses—like phishing, SIM-swapping, and poor user experience—are making it obsolete.

With a TaaS provider like OXIO, an eSIM can be turned into a secure, programmable identity layer enabling a new wave of identity management where businesses can embed hardware-bound authentication directly into their apps. This helps banks to ensure secure communications on company devices and across all customer communications.

Low hanging fruit for fintechs

Leverage your trusted brand reputation

Launching a bank MVNO shouldn’t require heavy marketing spend. Banks already have trusted relationships with millions of customers – making it easy to upsell a telecom offering that feels like a natural extension of existing services.

Everyone needs connectivity. The key isn’t convincing customers why they need it—it’s showing why they should get it from you.

Utilize your insights into financial transactions

Banks and fintechs are sitting on powerful data on their customers and where they spend their money. By analyzing transaction data, they can easily identify which telecom providers their customers use and how much they spend. With minimal effort, this data can be leveraged to offer more competitive connectivity plans and personalized deals—driving acquisition, improving loyalty, and positioning banks as smarter, more relevant mobile service providers.

Offer installment-based payment plans if operating in lower-income markets

Another consideration is mobile installment options for customers. In regions where prepaid connectivity dominates, many consumers can’t afford 30-day plans and instead buy shorter-term access—often switching providers based on daily or weekly deals. While seemingly cheaper, this approach usually costs more over time.

For banks and fintechs operating in lower-income markets, this presents a unique opportunity: boost MVNO acquisition and promote financial inclusion by offering monthly telecom plans with flexible, weekly interest-free instalment payments – helping fintechs to drive high growth acquisition numbers while also promoting true financial inclusion.

How to use subscriber BI to drive success as a bank MVNO

For banks and fintechs the opportunity doesn’t just lie in the ability to offer mobile services to customers – despite this likely being a profit centre from day one. With the right provider, this opportunity can go even deeper through the valuable business intelligence that can be generated from a global telecom core.

With a Telecom-as-a-Service (TaaS) provider like OXIO, who operates its own global network and telecom core, unique subscriber intelligence can be collected and surfaced to bank MVNOs and then used to power KPI improvements across the business. Here are some examples of the ways this subscriber intelligence can be leveraged by bank MVNOs:

Loyalty and data rewards

Data rewards present a powerful and cost-effective tool for banks and fintechs to drive engagement and promote positive financial behaviors.

With a telecom offering, banks can build highly effective loyalty programs—rewarding customers with free mobile data when they use their debit or credit cards, pay off balances on time, or refer friends and family. Even completing financial education courses could earn users data rewards, reinforcing good money habits while deepening customer loyalty.

Banks also have the opportunity to zero-rate their apps and digital services—ensuring customers can access essential financial tools even when they’ve run out of data. This strategy not only encourages greater app usage but also strengthens loyalty by making banking more accessible and dependable. It’s a simple, cost-effective way to create synergy between financial services and connectivity while delivering meaningful value to the end user.

Customer insights and segmentation

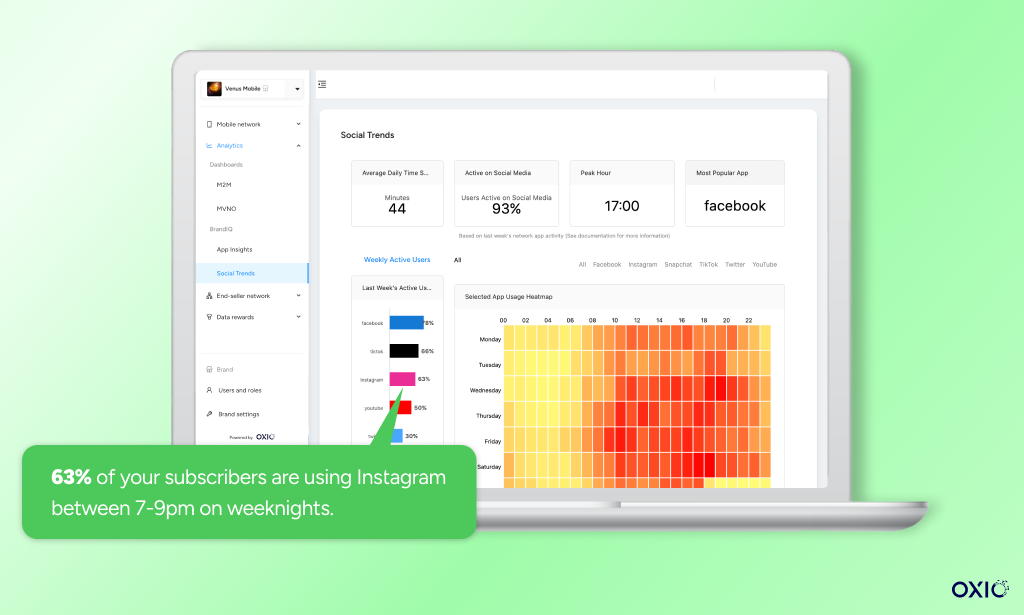

With OXIO’s unique data offering, banks gain a next-level understanding of their users and can segment them accordingly. Data that can help determine a subscriber’s socio-economic status, location patterns, mobility trends, social media activity, and usage of financial services and apps can be surfaced to deliver a comprehensive 360-degree customer view.

Banks can use this data to power their marketing campaigns, both online and offline. Knowing what social media apps customers use and when, will give banks the information they need to reach customers online effectively, and understanding the location of different cohorts of customers can ensure offline marketing, such as posters at bus stops, are erected in the most effective locations.

Credit scoring and financial qualification

A holy grail for fintechs and banks. By leveraging business intelligence and artificial intelligence, banks can understand the risks associated with each of their customers and help improve key metrics such as bad debt and repayment rates, for example.

Since every fintech and bank is unique, each will have to build, develop and customize their own models but with the right partner and BI/AI, banks can fine tune the impact this level of data can have for their business and the financial inclusion of the populations they serve.

The next chapter for fintech transformation

Expanding beyond traditional banking has never been more accessible or more strategic. With the rise of cloud-native platforms, AI and disruptive telecom technologies, embedding connectivity into the banking experience is now a powerful way for financial institutions to differentiate and grow.

In a world where consumers demand simplicity, flexibility and value, the convergence of mobile and financial services meets those expectations head-on – delivering seamless, cost-effective experiences tailored to modern lifestyles.

For enterprise banks, these innovations offer a long-overdue remedy to the challenges of non-compliant communications. With cloud-based telecom, banks can meet regulatory demands while delivering personalized, secure connectivity for employees around the globe.

At OXIO, we’re reimagining telecom. Our Telecom-as-a-Service (TaaS) platform empowers fintechs and banks to evolve beyond traditional offerings – unlocking new value, driving loyalty, and positioning themselves as next-generation brands that serve customers on every level.

For a more in-depth guide on how TaaS can unlock new possibilities for fintech businesses, download our eBook ‘The Telecom-as-a-Service Blueprint for Fintech Success’.