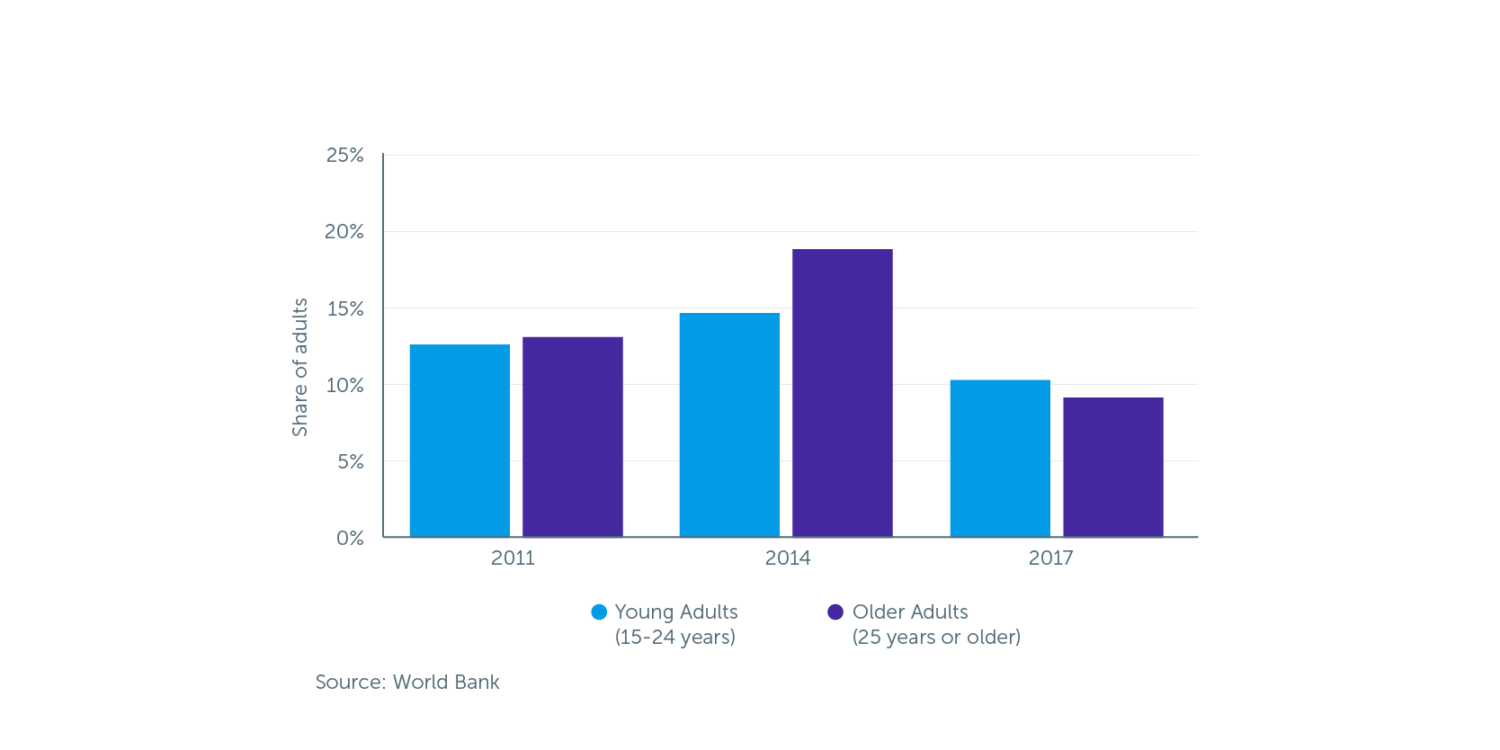

Credit card payments have become a staple in the world, however, credit card adoption in Mexico has been slow. According to Statista in 2017, 9.22 percent of Mexicans aged 25 or older owned a credit card, down from approximately 18.88 percent in 2014.

However, with the increased proliferation of mobile apps like Uber, Spotify and even Netflix during the pandemic joined by the push from new fintech startups and cheaper offers by big banks (like Saldazo OXXO by Banamex) Mexicans have been more open to engage with online payments.

So, when we first launched our mobile services with only prepaid plans we never imagined the huge demand from our customers to accept credit card payments, however we received so many requests for them we had to prioritize the feature.

There was a considerable development effort because the processor we chose, while being very well known and well regarded in the telecom industry, is a bit old fashioned, and wasn’t geared towards a mobile environment (meaning to initiate the purchase inside of the mobile device). However by developing and certifying the process ourselves we can guarantee that the integration is done correctly and have the best results.

Mexicans are considerably weary of online fraud, so we knew we had to provide certainty and security to people using this process on our system. There are two big issues we focused on: fraud and privacy.

While most credit card processors provide some sort of fraud detection, we found out that, because they charge only for successful transaction and not fraudulent ones, so, it is to their advantage to pass as many transactions as possible and if there are a lot of fraudulent ones the cost would be on the recipient of the payment (in this case, us!). The credit card processor we chose gives us a fraud guarantee which means that they are financially liable for any fraudulent transactions which aligns their interest with ours in keeping fraud down to a minimum.

Our user’s privacy, their names, address, and now credit card information is of the utmost importance to OXIO. It is embedded in our core values to manage and store our customer’s valuable information safely and anonymously to the best of our ability. For this, we removed ourselves from the process altogether and, while the payment process happens inside OXIO’s white-label app, we don’t see any card data in our system, it all goes directly to the processor (which is a regulated financial institution) that way this highly sensitive information is shared directly between the end user and the processor.

Right now the credit card payment process is enabled for our internal customers, friends and family and one of our clients, and we plan to implement this throughout the rest of our customers in the near future so every end user that uses the OXIO ecosystem will be able to purchase their mobile plan in a simple, fast and secure manner.